how much does a tax advocate cost

Irs Taxpayer Advocate Service Local Contact Hours Get Help Our Leadership The National. 26 special election for public advocate an office with an annual budget of 35.

Waiting since I25 have.

. The way they calculate and assess these fees vary widely by organization as noted below. In order to get a business tax ID number youll have to fill out an online application at IRSgov and provide the necessary. How much does a tax advocate cost Wednesday June 8 2022 Edit.

TurboTax Online Free Edition This version allows you to file form 1040 for free. How much does it cost to buy tax software. How To Get a Tax ID Number in 3 Steps.

As of September 2022 the excise tax on gas in New Mexico is 017 per gallon of unleaded gasoline. Ad 4 Simple Steps to Settle Your Debt. When you charter a yacht you dont have to pay.

Ad BBB Accredited A Rating. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Can the help find out info about refunds.

Excise tax refers to any tax imposed on a manufacturer of a good service. The Board of Elections put the cost of running the contest at 15 million. What do they do.

Ad Immediate Permanent Tax Relief. Every attorney will charge a different hourly rate but most rates are between 200 to 400 per hour. End Your IRS Tax Problems - Free Consult.

Ad Search For Info About How much does a tax attorney cost. It will cost the city as much as 23 million to conduct the Feb. Though CPA fees vary by location and expertise their tax services cost 174 per hour on average in 2020 and.

The estimated total pay for a Taxpayer Advocate at IRS is 75521 per year. Tax relief professionals charge fees for their services. Ad BBB Accredited A Rating.

End Your IRS Tax Problems - Free Consult. Here is the cost to file your taxes with TurboTax. You will be happy to know that the Taxpayer Advocate Service is a free service to use if you qualify.

The cost to charter a yacht varies widely depending on several factors it can run from around 50000 to over 1 million. Ad BBB Accredited A Rating. Time-based tax professional fee structure.

The majority of tax attorneys charge by the hour. How much does a tax advocate cost Sunday March 20 2022 Edit. You can call your advocate whose number is in your local.

Yes you read that right. How much does a tax attorney cost. How much does an Advocate cost.

Ad Top-rated pros for any project. This number represents the median which is the midpoint of the ranges from. End Your IRS Tax Problems - Free Consult.

What is a Tax Advocate for. How much does it cost to take a vacation. We have at least one local taxpayer advocate office in every state the District of Columbia and Puerto Rico.

Big bucks for a small office. How Much Money Does the Taxpayer Advocate Service Cost. TurboTax Online Deluxe Edition 59 This.

This Infographic From The National Taxpayer Advocate Highlights Some Of The Most Serious Problems Faxing Taxpayers Today.

What Is A Taxpayer Advocate And Should You Contact One

Tax Preparation Fees How Much Does It Cost To Have Your Taxes Done

Tax Advocate India Income Tax Lawyer Consultant Delhi Taxation Law Firm

County Surcharge On General Excise And Use Tax Department Of Taxation

How Much Does A Tax Attorney Cost Cross Law Group

Unexpected Tax Bills For Simple Trusts After Tax Reform

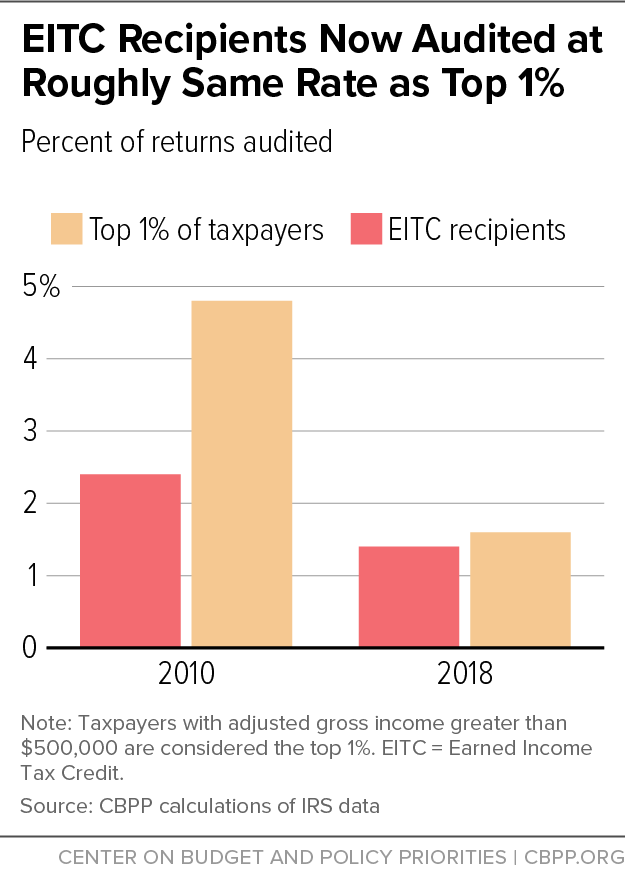

Biden S 80 Billion Plan To Boost Irs Audits May Target Small Businesses

Irs Taxpayer Advocate Notes From Call 4506 T And Related R Eidl

Depletion Of Irs Enforcement Is Undermining The Tax Code Center On Budget And Policy Priorities

What Does A Taxpayer Advocate Do Smartasset

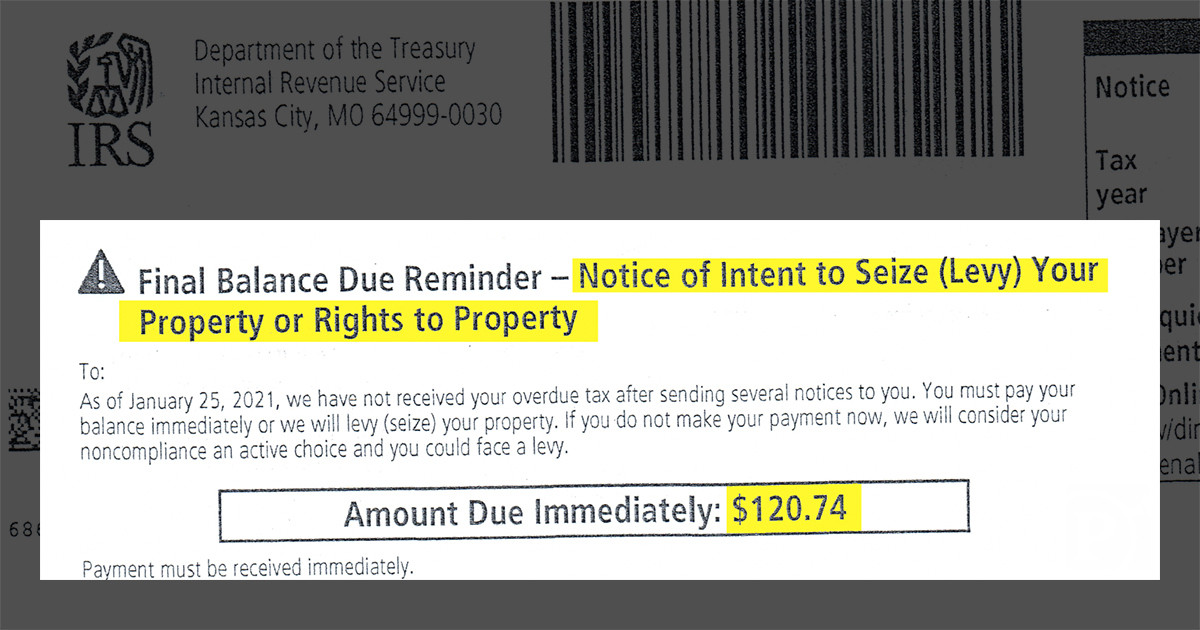

The Irs Cashed Her Check Then The Late Notices Started Coming Propublica

Contact Us Taxpayer Advocate Service

Advocate S Taxpayer Impact Statement Pitch Headed To Austin Council

Irs Hits Gridlock In Collision Of Tax And Social Services Roles

Tas Tax Tip Get Current On Your Federal Taxes Tas

2022 Attorney Fees Average Hourly Rates Standard Costs

Solved Question 1 Why Does The Former National Taxpayer Chegg Com

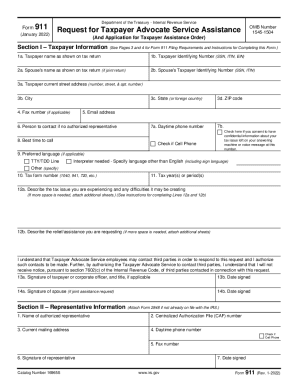

Irs Form 911 Fill Out And Sign Printable Pdf Template Signnow